How Do I Pay Quarterly Taxes 2025. How to pay quarterly taxes the irs provides multiple payment methods. Peter contributes $345 for the july to september quarter to sue’s super.

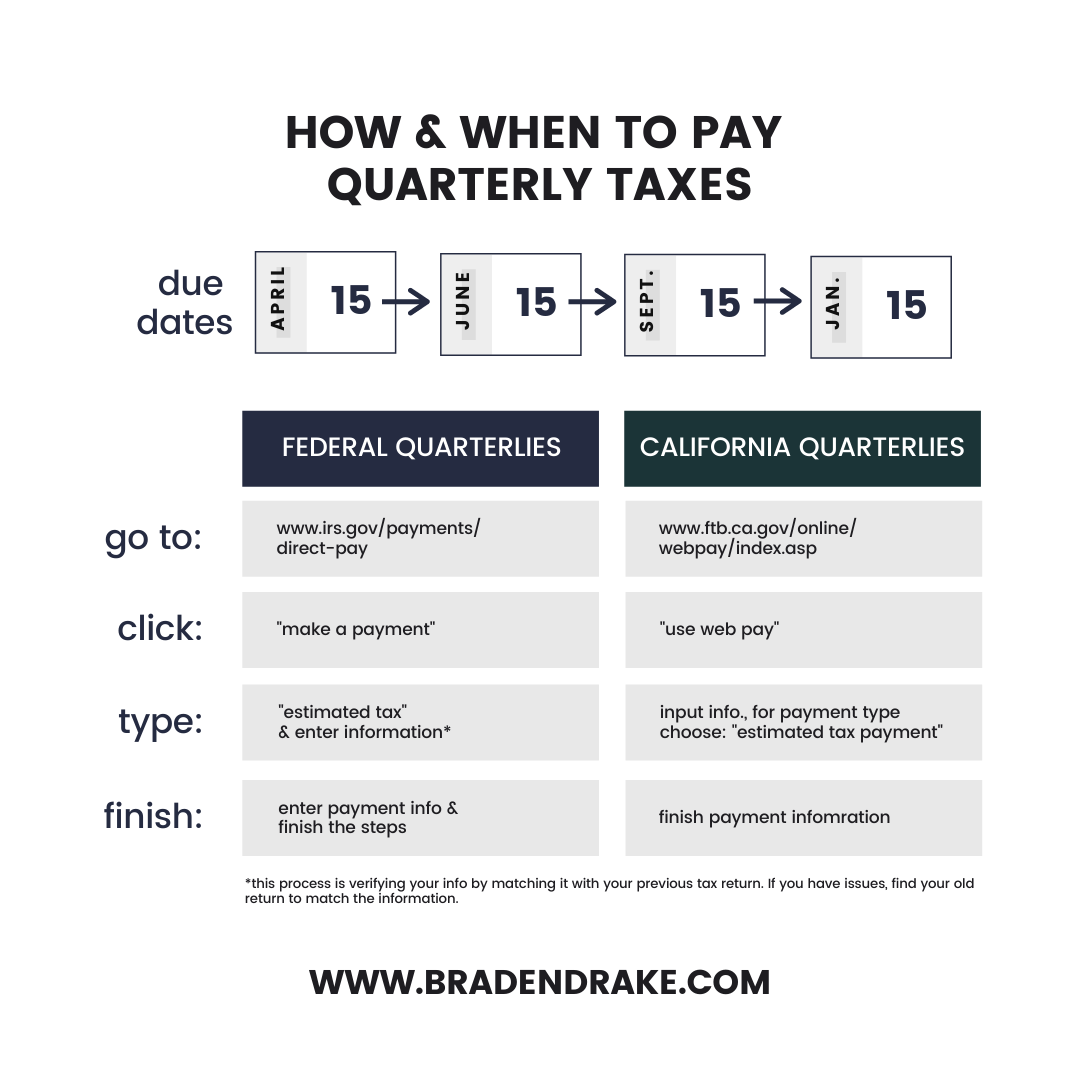

It provides crucial dates and deadlines for submitting returns, paying. You can still use the form to estimate taxes, but if you typically pay your taxes online, you can pay any estimated taxes due using your online account.

This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

How to Calculate and Save Your Quarterly Taxes, If you have little or no income tax withheld from wages and earn significant other income, you may need to make quarterly estimated tax. When to make estimated tax payments.

Quarterly Tax Calculator Simplify Estimated Taxes FlyFin, Do you have to pay estimated taxes quarterly? When to make estimated tax payments.

How to pay estimated quarterly taxes to the IRS YouTube, Peter contributes $345 for the july to september quarter to sue’s super. If you have little or no income tax withheld from wages and earn significant other income, you may need to make quarterly estimated tax.

How to Calculate and Pay Quarterly Estimated Taxes Young Adult Money, While the 1040 relates to the previous year, the estimated tax form. If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you.

Quarterly Taxes Explained How to Pay Estimated Taxes YouTube, Here’s all you need about the various aspects of advance tax payments. $3,000 × 11.5% = $345.

How to Calculate and Pay Quarterly Estimated Taxes, The irs allows you to submit estimated quarterly tax payments in the following ways: Peter contributes $345 for the july to september quarter to sue’s super.

How to Pay Quarterly Estimated Taxes YouTube, Peter contributes $345 for the july to september quarter to sue’s super. The income tax calendar for the f.y.

How to Pay Your Estimated Taxes Online with the IRS (Quarterly Taxes, You can pay with a debit card or a bank account, via cash or check, or through the. $3,000 × 11.5% = $345.

How to Pay Quarterly Estimated Taxes YouTube, Pay estimated taxes by mail. Payment is due by september 16.

How To Pay Estimated Quarterly Taxes YouTube, You can still use the form to estimate taxes, but if you typically pay your taxes online, you can pay any estimated taxes due using your online account. It provides crucial dates and deadlines for submitting returns, paying.